The vague expectations of a decisive presidential election victory for Biden boosted bonds, and the Democratic sweep of the White House and Congress lifted the dollar as a set of trades based on the “Blue Wave.”

In recent days, investors have speculated that a pre-poll opinion poll could lead to a decisive democratic victory for the epidemic-stricken U.S.

Mr Biden could still win the presidency in this tight race. But Donald Trump Wins in Florida And Ohio lowered investors’ expectations of a big win for the Democrats. The strong performance of Republicans in many war-torn states encourages money managers to be prepared for the possibility that the outcome will remain unclear for days and that the U.S., which has put investment in perspective, could be left with a divided government.

“The Blue Wave ‘trade has been going on since the summer and has only recently grown, and now I expect it to be resolved. But other than that, there is no point in selling the result in this environment,” said Fabiana Fedelli .

“In the short term, I think we’re fixing it,” he said, adding that the path to economic stimulus and the coronavirus epidemic are more significant drivers in the markets than just the outcome of the election alone.

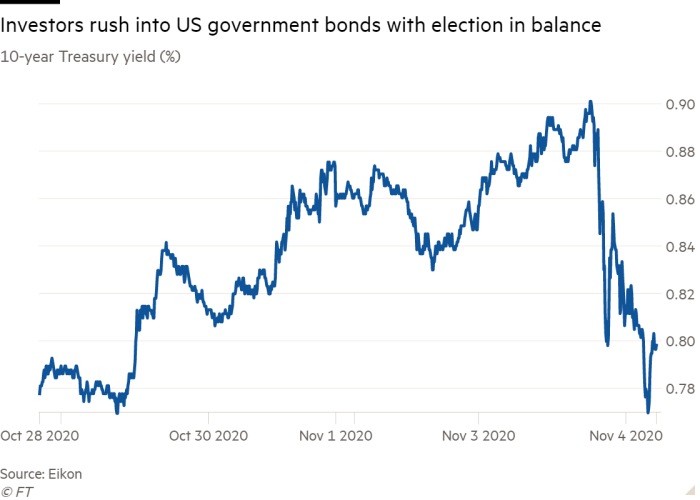

The 10-year Treasury yield soon picked up 0.9 percent on Tuesday evening – hitting a post-June high – on the assumption that a major democratic victory could ruin government spending and potential inflation. In turn, it is expected to put further downward pressure on long-term bond prices and send yields rising.

But yields fell 0.8 percent below Wednesday morning, showing just how badly fund managers have been caught. Didier Saint-Georges, head of portfolio advisors at French investment house Carminak, said: “Markets need to keep a close eye on their systems.

The dollar strengthened along with treasury gains, rising 0.4 per cent against the euro and 0.4 per cent against the Japanese yen.

Live updates

U.S. Follow the latest election news Here.

U.S. Stock futures were volatile. Observers on the blue-chip S&P 500 index rose 0.7 percent in European trade on Wednesday, staying close to 2 percent overnight.

Trading the Nasdaq 100 Index, which weighs heavily on major tech groups in the U.S., has seen a 2 percent increase in futures, which was halted shortly after a sharp rebound on Tuesday night. European stocks were significantly lower as regional stocks fell 0.2 percent to 600.

“Futures markets offer prices in a Trump victory, which I think is a bit premature,” said David Bailey, chief investment officer at Citi Private Bank.

The president promised to go to the Supreme Court to stop the counting of votes as he claimed a false victory in the White House race after further uncertainty erupted early Wednesday.

“Over the next few days there will be a very chaotic news flow,” said Mr. St.-Georges at Carmignac.

Additional reporting by Lure Rance Fletcher in London and Leo Lewis in Tokyo