Unpaid household expenses designed up all through lockdown will direct to a spiral of debt for many until financial support is presented, according to Citizens Information.

A single in 9 persons have noted becoming unable to keep up with residence costs – the equivalent of six million men and women throughout the United kingdom, according to study by the charity.

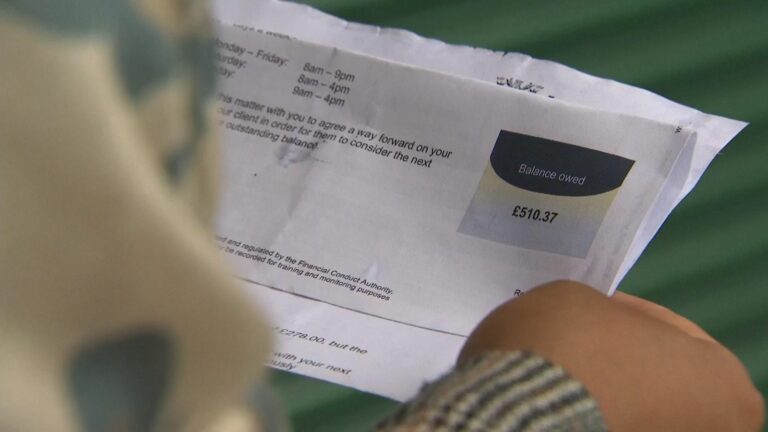

“Laura”, who wants to continue to be nameless, had been operating difficult to apparent her money owed in advance of the pandemic, but a overall health affliction intended she could not carry on in her new job and she was informed she would not be furloughed.

“I was managing and then this has place me back again to square one particular,” she said.

“When you are in your overdraft and you are borrowing income… it does place you in a circle where by, when you get paid out once more, you have received to pay that off and it starts off more than again.”

She has fallen powering on her council tax and mobile phone invoice as effectively as other debts and is now functioning double shifts to get again on her toes.

“It tends to make you truly feel worthless when you won’t be able to even consider your small children out for a wonderful day. It got me upset and stressed.”

The study discovered that one in 4 men and women, who are mothers and fathers or carers, have fallen at the rear of on their family payments as perfectly as just one in 5 key employees.

And just one in five of those people manufactured to defend, which means they will need to keep at household owing to a wellness condition, have also missed payments.

Of the six million having difficulties to fork out the expenses, one in 10 have been unable to pay for foodstuff and a single in five have bought possessions to make ends satisfy.

It does not enable that steps built to assist safeguard income through lockdown are coming to an end.

But Laura feels she’s fallen amongst the cracks when it arrives to acquiring help.

“I truly feel there is enable out there for some folks but you have received to tumble into the ideal group… and if you will not, it is really actually tough to cope.”

Katie Martin, director of exterior affairs for Citizens Assistance, says the economic affect of coronavirus is not becoming felt similarly.

“It’s normally those that ended up struggling most in advance of the disaster that are battling now,” she reported.

“We are urging the government to acquire some action to make confident people today can recover from these debts swiftly and get back again on the street to restoration as the economic system recovers.”

She said she thinks the price tag could be shared between the government, collectors and the men and women where by feasible.

“We do not assume it ought to be handout. We think there could be fascination-absolutely free financial loans the place acceptable but that is really anything we need to get the job done via and see what is appropriate for diverse spots.”

She also says it truly is vital that people do not wait around to seek out help.

“The most important matter is that individuals get motion definitely, actually swiftly.

“Conversing to the persons you owe income to, you can generally set up reimbursement programs or diminished amounts. Which is the most essential factor – that you will not pretend it is not occurring.”