Dow Jones futures with S&P 500 futures and Nasdaq futures will not open until Sunday evening. The stock market suffered one more defeat this week. Negative contrast, given key support and suffrage procedures by leaders like Paul Stoke, Amazon.com (AMZN) And Netflix (NFLX) Assume mild weekly losses of key indicators.

X

With the main points of the Tesla Battery Day weekend, Tuesday’s news has a big deal for Tesla stock, the EV industry and the broader market. As well as Tuesday night, KB Home (KBH) Dow Jones huge earnings and quarterly results Nike (Of).

Meanwhile the fate of the ticket ok is in the air. Does President Donald Trump accept tickets ok ok?Oracle (ORCL) Will deal, or U.S. The government will ban new ticket ok app downloads Apple (AAPL) And Google App Stores on Sunday?

The stock market outlook looks grim

The main index trades in whipso fashion, which is close to the weekly low. The expectation is more vulnerable, albeit at least trying to get key support.

On the plus side, while the stock market is constantly losing, it is not collapsing. The Bulls are still fighting, while such incomprehensible leaders Tesla (TSLA) And KB Home Stock had solid to strong gains or at least had their ground like Nike Stock, Adobe (ADBE) And Service now (Right now).

The rally in the stock market is still a “correction under pressure” with pressure under pressure.

The Bulls are running a fight, but the Bears have landed in most punches. Volatile side market growth with downside bias is the worst potential scenario for investors.

Investors should focus on defense.

IBD Leaderboard Apple removed Pall, Amazon and Netflix stocks on Friday. Tesla, Nike, Service Now and Adobe stock are still on the leaderboard. Adobe and service stock IBD long-term leaders. Adobe, Netflix and Amazon are in stock IBD50 List.

Top 5 stocks near buy points as the economy revives

Dow Jones futures today

Dow Jones futures begin trading on Sunday at 6 p.m. So will S&P 500 futures and Nasdaq 100 futures. Remember that in the overnight action Dow futures And somewhere else the next routine doesn’t necessarily have to translate into real trade In the stock market Session

Join IBD experts as they analyze the additional stocks in the stock market boom on IBD Live.

Corona virus news

The number of coronavirus cases worldwide has reached 30.84 million. The Covid-19 death toll peaked at 958,000.

U.S. There have been 9.94 million cases of coronavirus in India, in which 203,000 people have died.

Stock market rally last week

US stock market observed today |

||||

|---|---|---|---|---|

| Index | Symbol | Price | Advantages / disadvantages | Change% |

| Dow Jones | (0 DJIA) | 27657.29 | -244.69 | -0.88 |

| S&P 500 | (0s and p5) | 3319.28 | -37.73 | -1.12 |

| Nasdaq | (0NDQC ) | 10793.28 | -117.00 | -1.07 |

| Russell 2000 | (ETC.) | 153.29 | -0.40 | -0.26 |

| IBD50 | (FFTY) | 36.15 | -0.19 | -0.52 |

Last updated: 4:18 PM ET 9/18/2020 |

||||

The boom in the coronavirus stock market was mild, nothing weekly – if you only look at the percentage change.

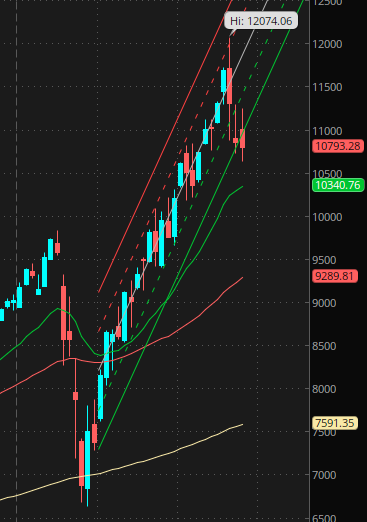

The Dow Jones Industrial Average lost just 0.03% last week Trade in the stock market. The S&P 500 Index retreated 0.65% and the Nasdaq Composite retreated 0.6%. But while it was a modest move, it all closed near the weekly low, even with a Friday afternoon surge. The S&P 500 and Nasdaq finished below their 50-day lines and cut their recent lows.

Some of the new breakouts went to Fiji while the stock market boom caused significant losses to many big winners.

Apple Pall fell 6.6% last week, its third straight big weekly loss and knit from its 10-week line. Amazon stock has plunged 5.2% after already closing below its 10-week line. Netflix lost 2.5%, but is now down 4.6% from a 10-week low.

In the semi-full / semi-empty field in glass, Adobe has sunk only 0.8% while service has risen 1.6%. Both faced mid-week reversals – especially Adobe stock after earnings – but they did not find support in their 50-day line.

KB Home jumps 6.2%, moving into the buy zone. Nike retreated 2.8%, but after six straight weekly gains. The Dow Jones huge stock chart looks great.

In between The best ETF, Innovator IBD 50 ETF (FFTY) Managed to grow 0.4% for the week, albeit better than the mid-week highs. IShares Extended Tech-Software Software Field ETF (I.G.V.) Ticked up 0.3%. Vanek Vectors Semiconductor ETF (SMH) 1.3% advanced, but the chips did not bounce much on Friday afternoon.

Why this IBD tool simplifies the search for top stocks

Tesla Battery Day

On Tuesday night at Tesla Battery Day, the electric car leader announced the progress of the “million mile battery” as well as the cheaper, denser better design and in-house manufacturing process. How much will Tesla deliver or promise in advance, and when will they arrive in vehicles? The work may also include updates about other Tesla vehicles, plants and projects. The company is holding its annual shareholder meeting on the same day.

Tesla shares rose nearly 19% last week, after a big jump from its 10-week line in the previous week. It’s clearly been the biggest cap tech of the last week or so. It forms a handle-like structure.

But stock action has been very volatile over the past few weeks, with nothing like the right base. If Tesla delivers great news on Tuesday night, the stock could run second. But perhaps the good news is already worth it. Tesla’s spike is due to more battery day leaks and buzz than last week. The long-awaited, long-delayed Tesla Battery Day event has been a TSLA stock catalyst for almost a year.

If Tesla is disappointed, the stock’s reaction could be sharp.

However, beware of the first impression. Tesla stock may bounce or dive into the overnight session and open hours on Wednesdays, but then reverse during the day.

Even if the Tesla stock action on Tesla Battery Day is positive or negative, the headlines will keep coming.

O’Neill Protege é analyzes the current market and these six leaders

VW ID4 Event, Tesla Delivery

Volkswagen (VWAGY), Which has just begun European delivery of the ID.3 EV hatchback, will formally unveil the ID.4 crossover on September 23, a rival to the Tesla Model Y. ID.4 Reservations Europe and U.S. The event will then begin in, with deliveries before the end of the year. China production of the ID21 will begin next month with delivery in early 2021.

ID.3 and ID.4 are among the dozens of VW Group electric vehicles that will roll out in the next two to three years using its MEB platform.

Meanwhile, Tesla delivery in the third quarter will arrive in early October, with the in-China Model Y launching quickly, as well as other potentially big news or buzz for Tesla and competitors.

Share Market Rally: Band, Band, Band

The stock market rally is facing increasing pressure after three negative weeks. The Nasdaq and now the S&P 500 are below their 50-day moving averages. Both Sept. 11. Sept.

The stock market rally is facing increasing pressure after three negative weeks. The Nasdaq and now the S&P 500 are below their 50-day moving averages. Both Sept. 11. Sept.

The Nasdaq is now below the standard deviation dotted line from the regression chart during the stock market rally.

Yes, the main indexes close their intraday lows on Thursdays and Fridays, but they have reached a low once again in the weekly series.

With a few exceptions like Draftkings – the new purchase is not working. Support is breaking or worse in most leading stocks. Those who hold it, sometimes leaders will be resilient until finally cracked.

The bear has an upper arm.

The expectation is more vulnerable. The S&P 500 and Nasdaq could try to reclaim their 50-day moving averages, and they could. But they will quickly cope with them 21-day exponential moving average And other short-term resistance levels.

The lack of market fear – as measured by the CBOE Volatility Index and the put / call ratio – does not point to near-term lows.

A wild card is a new coronavirus stimulus deal. If Congress comes close to a new rescue package, it could certainly improve economic and stock market prospects.

If the rally in the stock market can remain stable, regain its 0-day line and go sideways, investors can generally keep their current holdings. That would be good news, at least in the short term.

If the Nasdaq finally gives way and the stock market corrects, there will be short-term pain, especially if you come into excessive exposure. But the market will stop tempting investors to make new purchases. In the long run new foundations are formed.

If and when the direction of the stock market is clearly positive, don’t expect a rip-off advance. From April to early September, the stock market was rising at an inadvisable pace. The Nasdaq Composite is slightly below its long-term trend line, which returns to 2010 on the monthly chart. Moving forward at that pace will bring strong benefits over time.

What to do now

For now, investors should be protective. You can continue to reduce damage and overall exposure. Analyze your holdings. Consider what big winners you still want to catch, especially if we introduce stock market reform. Even if the market returns overall, some of your stocks will not.

Remember, hope is not a strategy.

Make a list of your watches. Cast wide net. Some tech stocks are doing well, but don’t ignore transportation, housing and retail stocks like CSX (CSX), Atlas Air Worldwide (AAWW), KB Home, Target (T.G.T.), Dr. General (D.G.), Five down (Five), Home Depot (H.D.), Loves (Less) And R.H. (R.H.).

Focus on relative strength. Base and balish rebounds may develop later.

To read The big picture To keep pace with the daily market direction and leading stocks and sectors.

Follow Ed Carson on Twitter IBD_ECarson For stock market updates and more.

You may also like:

Coronavirus Stock Market Survival Guide

Catch the next big winning stock with Marketsmith

Want to make quick profits and avoid big losses? Try SwingTrader

The best growth stocks to buy and see

IBD Digital: Unlock IBD’s Premium Stock Listings, Tools and Analysis Today