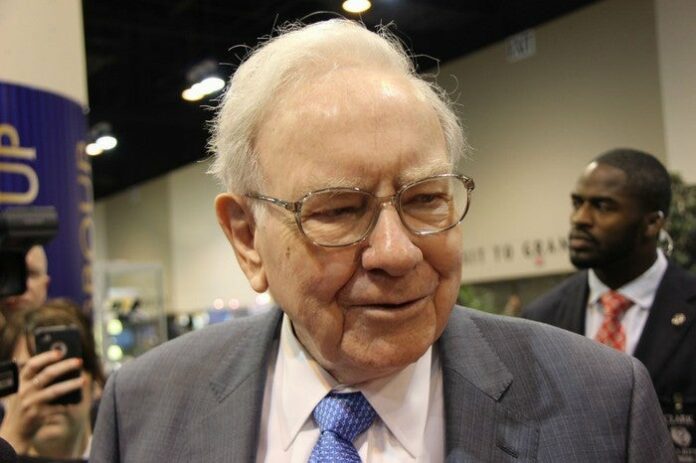

You can find out how different Warren Buffett is from a tight-knit robinhood investor. Only 90 years old, he is very experienced. He is arguably the most famous investor of all time and ranks among the richest people in the world.

Omaha’s Oracle may not fit Robinhood’s investor profile, but there are still stocks on the free online trading online trading platform that he likes. Here are three of the top 100 most popular Robinhood stocks worshiped by Buffett.

Image Source: The Motley Flower.

1. Berkshire Hathaway

On September 4, 2020, Berkshire Hathaway (NYSE: BRKA) (NYSE: BRK.B.) Robinhood ranks 71st in the top 100 list. No doubt about it, though it is Berkshire Vern runs as Buffett’s favorite stock.

Barfshire Hathaway was a textile company when Buffett took control in the 1960s. He transformed it into a huge mass over the years. Today, Berkshire’s market cap is close to 20 520 billion. Buffett continues to serve as chairman and CEO of the company and owns about 16% of the company’s remaining shares (including its Class A and Class B shares).

Buffett doesn’t think too highly of most stocks on the market right now because of his ep land valuation. Berkshire did not even have much use of its cash to invest during the stock market crash earlier this year. But there was at least one stock that Buffett still really liked: Berkshire Hathaway himself. The company spent more than 5 billion to repurchase its shares in the second quarter of 2020.

2. Apple

What is the most popular stock on Robinhood? Apple (Nasdaq: AAPL). It’s very close to being Buffett’s top stock.

Berkshire owns 245 million shares of Apple Pal. That is The company’s largest holding so far, Accounting for about 45% of Berkshire’s total investment portfolio. Buffett also said in an interview with CNBC earlier this year, “I don’t consider Apple Paul a stock. I think it’s our third-largest business.”

Why does Buffett love Apple Paul so much? “This is probably the best business I know in the world,” he told CNBC. Billionaire investor, not a big fan In tech stocks In the past, Apple has seen Paul as more of a consumer products company than a technology company.

Bank. Bank of America

Bank of America (NYSE: BAC) Robinhood is currently the 14th most popular stock among investors. There is a very good argument that economic services giant Warren Buffett is the third favorite stock.

Buffett has preferred bank shares for years. Berkshire owns big stakes in more than half a dozen banks, but Bank of America has reached the top spot among them. It is second only to Apple Pal in holding Berkshire’s portfolio.

In recent months, Buffett’s enthusiasm for the Bank of America seems to have only increased. Berkshire Made three major investments in stocks Total 7 1.7 billion during July and August Gust.

Should you love these stocks too?

Just because Berkshire Hathaway, Apple Pal and Bank of America don’t mean they have great stock to buy. The fact that one of the greatest investors chooses these three stocks also doesn’t necessarily mean they pick smart.

But should you love these stocks as much as Robinhood investors and Warren Buffett do? In my opinion, the answer is yes.

I think Berkshire, Apple Pal and Bank of America have strong potential for long-term growth. Berkshire and Bank of America also claim valuations that are more attractive than most stocks on the market, and after last week’s sell-off, Apple is at a lower price. In my view, all three seem to be a good pick for almost any investor.

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.