Today’s Bitcoin (BTC) futures expiry was lackluster equally in conditions of price influence and volume. Open desire dropped by a mere $157 million, hardly transferring from its $5 billion mark.

As CoinTelegraph the right way predicted yesterday, this most the latest CME Bitcoin futures expiry was irrelevant. Some $125 million worth of August contracts had been set to liquidate right now, even though preliminary info implies significantly less than $40 million have been not rolled above for the upcoming months.

Full open up interest, USD million. Supply: Bybt.com & CoinTelegraph

The chart over displays the whole open fascination modify around the past 24-hrs, whilst the information involves inverse swaps (perpetual) and the remaining calendar months.

Even so, this is strikingly reverse from the July expiry when $500 million value of futures contracts have been liquidated.

Expiry sizing is dependent on the latest cost exercise

The key explanation behind these traders’ indifference to today’s expiry appears to be the failure to create assistance degrees above $11,200 above the earlier number of months.

As CoinTelegraph talked about previously this week, the existing “macro aspects hint at a positive medium-phrase to lengthy-term selling price cycle but suggest that in the in the vicinity of term, momentum will fade and a consolidation phase will happen.”

Bitcoin intraday value chart, USD. Resource: TradingView

The markets behaved entirely in different ways more than the final months of each futures contract expiry, that’s why a unique final result on the amount of money that was liquidated. Late July presented a 26% bull run, while the earlier two weeks have been flat.

Open desire is more crucial than modest-sized expiries

Some traders may perhaps be upset by Bitcoin’s modern loss of momentum but this does not suggest that experienced buyers exited the futures markets. The absence of volume, or the steadiness of futures open up desire usually means bets have already been positioned.

Investors need to only stress when there is diminishing open up curiosity as this is an sign that savvy traders have minimized their publicity. This would be in particular regarding for the duration of consolidation phases.

Bitcoin futures mixture open interest. Source: Skew

These types of a bearish circumstance is not the case, as the total open up desire between all exchanges a lot more than doubled throughout 2020. The latest $4.9 billion mark is just $800 million shy of the historic superior reached on August 17.

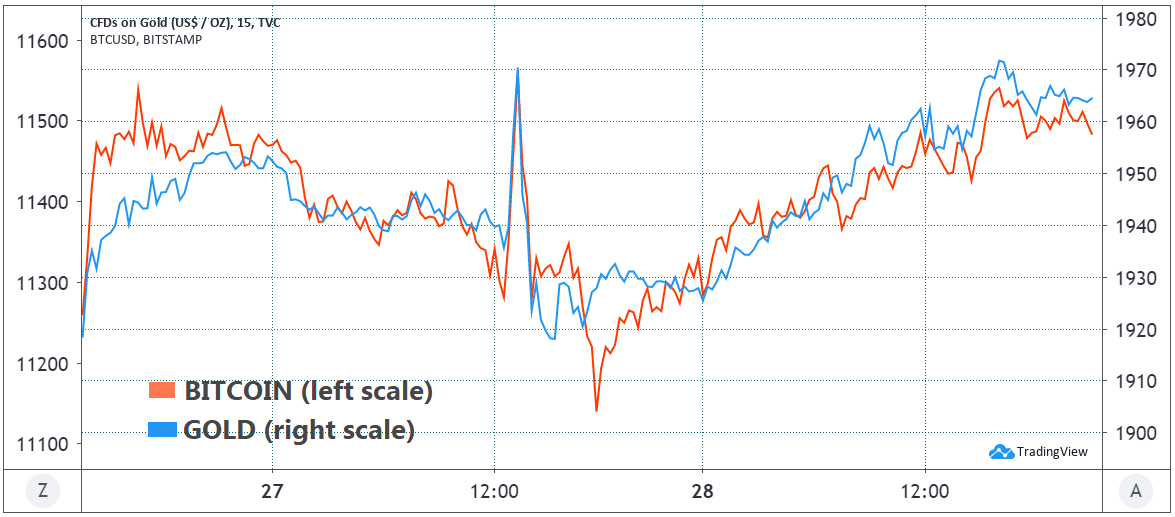

Bitcoin seems hugely correlated to gold and which is okay

Irrespective of the 30-working day and 90-working day correlations, limited intraday moves between gold and Bitcoin in some cases very last for a pair of times. This holds specifically accurate when big macroeconomic functions like this week’s Jackson Gap meeting dominate the scene.

BTC/USD, Gold price tag motion. Resource: TradingView

Make sure you take note that the higher than chart holds various scales as the p.c-based oscillations will range amid every single asset. However, the similarity in the intraday moves amongst gold and Bitcoin is quite remarkable.

This brief-phrase correlation need to not be interpreted as a signal of Bitcoin getting additional of a world wide reserve asset, but alternatively a reminder that crypto markets are noticeably impacted by the exact same external gatherings that guideline classic markets.

As for the remaining futures market expiries throughout the yr, just one should continue to keep a near eye on the foundation (contango) and leading traders extended/small ratio as both give worthwhile insight into the sentiment of larger sized buyers.

The sights and opinions expressed listed here are only all those of the writer and do not essentially reflect the views of Cointelegraph. Each and every expense and investing shift entails risk. You should really perform your possess exploration when building a selection.

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.