China’s economic climate returned to growth in the 2nd quarter, in a single of the world’s earliest indicators of restoration from the fallout of the coronavirus pandemic.

Gross domestic products grew 3.2 for each cent in the 3 months to the conclusion of June, as opposed with the exact same period final year, exceeding forecasts.

The figures abide by the first yearly drop in a long time in the prior quarter, when China’s GDP fell by 6.8 per cent as the region struggled to offer with the effect of the Covid-19 disaster.

The return to progress coincided with a period when new described conditions of the virus had fallen sharply and bigger condition aid for the industrial sector, even as consumption remained weak.

Liu Aihua, spokeswoman for the country’s Nationwide Studies Bureau, stated the figures “demonstrated a momentum of restorative expansion and gradual recovery”. But she also pointed to “mounting external challenges and challenges” as the virus continued to spread globally.

“We are self-confident on the financial recovery in the second half of this yr,” she extra.

Knowledge from China, the place coronavirus was first identified, is getting intently watched as economies close to the environment grapple with the results of the disaster.

Regardless of area outbreaks of the virus, like final thirty day period in Beijing, new day by day circumstances have typically remained in the tens for every working day in the second quarter as the pandemic has gathered tempo in the US, Europe and Latin The usa.

In April, China eased lockdown measures in Wuhan, the original centre of the virus, but has continued to implement stringent guidelines on screening and closed off the region to most global flights.

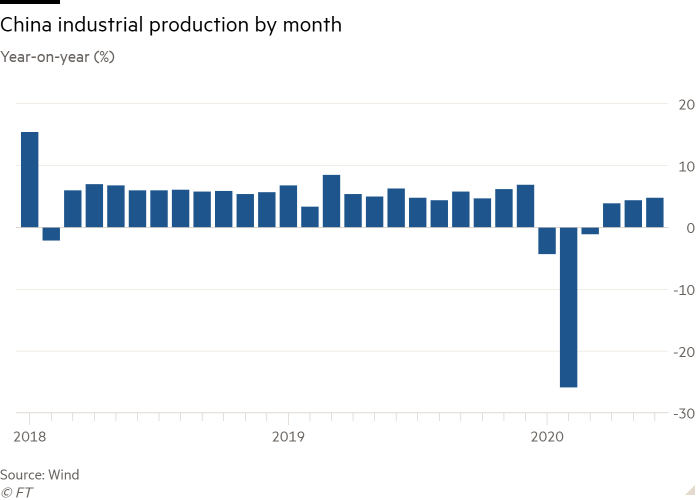

Mounting GDP in the second quarter was helped by solid industrial manufacturing, which increased 4.4 for every cent compared with the exact interval a yr previously and rose in each of the earlier 3 months.

The Chinese point out has supported industrial action above current months, in component as a result of raising the amount neighborhood governments can borrow for infrastructure projects. A rise in design has helped boost the country’s metal output when production has shrunk in other massive nationwide producers.

“In China the story is pretty reliant on what is occurring domestically,” mentioned Louis Kuijs, head of Asia economics at Oxford Economics. “The momentum really should be sturdy sufficient to make it really unlikely [we] see one more drop in GDP,” he extra.

Retail profits fell by 3.9 for every cent in the next quarter, signalling an uneven recovery and continued stress on usage. The unemployment fee in June was 5.7 for each cent, a slight improvement on May’s figure of 5.9 for every cent.

Marcella Chow, world wide current market strategist at JPMorgan Asset Management, pointed to the substantial price savings rates of domestic people about the training course of the pandemic, but additional that consumption could get better quickly if assurance returned.

Most recent coronavirus news

Comply with FT’s stay protection and examination of the worldwide pandemic and the rapidly evolving financial disaster below.

China reported optimistic trade details this 7 days, which confirmed exports unexpectedly increasing by .5 for each cent in June as opposed with very last 12 months. But Ms Chow reported that exterior desire for Chinese exports could stay weak as a end result of lockdown measures in Europe and the US.

Shares in Asia-Pacific marketplaces retreated soon after the info have been introduced.

The CSI 300 index of Shanghai- and Shenzhen-mentioned shares was down 1.6 for each cent and Hong Kong’s Hang Seng index fell by 1.2 for each cent. In Japan, the Topix dipped .6 per cent and Australia’s S&P/ASX 200 was down .9, although the Kospi in South Korea drop .6 per cent.

“Markets Really don’t like the unenthusiastic Chinese spenders,” Trinh Nguyen, senior economist for emerging Asia at Natixis, wrote on Twitter.

Additional reporting by Alice Woodhouse in Hong Kong

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.