In a 7 days in which the S&P 500 established a file in the midst of a pandemic, it is fair to at minimum think about the bottom 495 or so parts.

Michael Batnick, the director of analysis at Ritholtz Prosperity Management, factors out 94% of the S&P 500

SPX,

components are investing under their 52-7 days highs, though the median attain is 63% from its 52-7 days reduced. This chart definitely demonstrates how tilted the recovery has been towards the more substantial corporations.

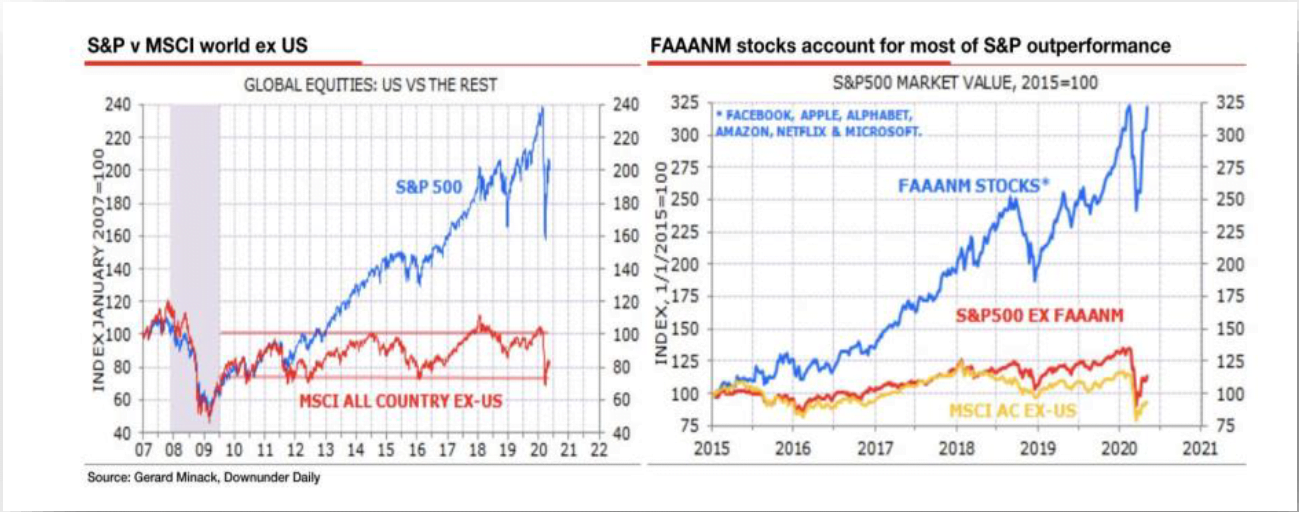

Christopher Pavese, chief financial commitment officer at North Carolina boutique financial commitment company Broyhill Asset Administration, posts a very similar chart evaluating the MSCI All-Place ex-U.S. index to the S&P 500, which by itself is just pushed by the technological innovation giants.

Pavese outlines all the uncertainties — together with no matter whether there will be a second, or 3rd wave, of coronavirus, how several enterprises will fold and whether history stimulus will create rampant inflation or whether or not the crisis will result in deflation. “What we do know is that we have hardly ever seen inventory costs at this sort of extremes coincide with this degree of uncertainty. We also know that dwelling in an imaginary environment of certainty can build major issues handling income in the true environment,” he claims in an investment letter.

Pavese claims there are about to be the greatest alternatives in distressed investing in a decade, as he phone calls the current market place unsustainable.

“If marketplaces are investing at 50 percent of today’s ranges in a 12 months or two, it will seem noticeable to all people in hindsight, that today’s inventory rates and severe divergences had been totally unsustainable,” he writes. “The consensus is eager to appear earlier today’s earnings, by means of to next year’s V-formed rebound in profits. But we are a extended way from something that resembles regular, as revenue margins are probably to keep on being depressed by profits shortfalls and incremental charges for many years. As a outcome, today’s inventory charges, even now levitating near all-time highs, leaves little margin of basic safety and even significantly less to get psyched about.”

The buzz

Former Vice President Joe Biden officially acknowledged the Democratic presidential nomination, saying the U.S. will get over what he referred to as a “season of darkness” less than his rival, President Donald Trump.

Pfizer

PFE,

and BioNTech

BNTX,

say their lead coronavirus vaccine applicant brought on a robust immune response and they could seek out regulatory review as early as October. If permitted, they presently strategy to source up to 100 million doses around the globe by the conclusion of 2020, and approximately 1.3 billion doses by the stop of 2021. Johnson & Johnson

JNJ,

meanwhile, is preparing a 60,000-person late-phase demo of its COVID-19 vaccine.

Deere & Co.

DE,

rose in premarket trade right after the agricultural devices maker claimed improved-than-forecast effects.

Tesla

TSLA,

continued to drive higher, with the electrical vehicle maker investing at $2,035 in premarket trade.

Present property product sales knowledge could clearly show a jump in July, and flash U.S. production and companies information are also because of. The IHS Markit flash eurozone composite purchasing managers index slipped to a two-month very low of 51.6 in August from 54.9 in July, as the U.K. mentioned government financial debt topped £2 trillion for the initial time.

The markets

U.S. inventory futures

ES00,

YM00,

NQ00,

traded weaker.

The euro

EURUSD,

retreated soon after the weak PMI readings. Gold futures

GC00,

slipped.

The chart

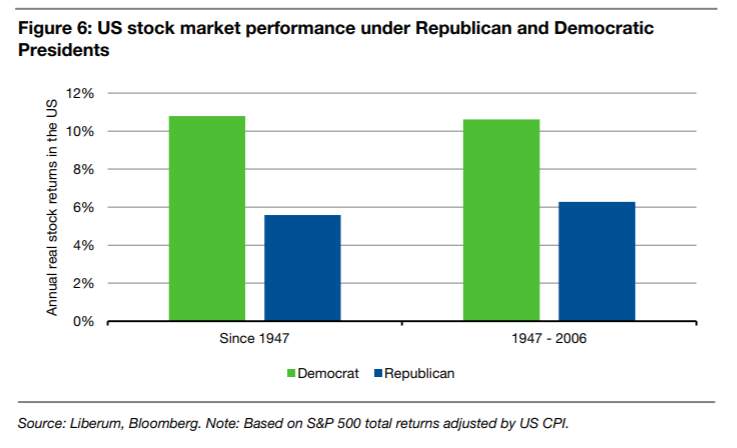

Liberum Funds Marketplaces produced this chart displaying inventory-current market returns in the U.S., adjusted for inflation, are greater beneath Democratic presidents. The broker also screened for the ideal carrying out U.K. and European stocks below various administrations. Below Republicans, U.K. beneficiaries are prescribed drugs — notably GlaxoSmithKline

GSK,

— defense contractors, and foods and tobacco, and European shares that do nicely are inclined to be in wellness treatment and utilities. Less than Democrats, media providers and real estate investment trusts in the U.K., and automotive and media shares in Europe, are the beneficiaries.

Random reads

What could be much better than chocolate snow?

You may well have listened to of beer flights or whiskey flights. 1 restaurant is presenting gravy flights.

Will need to Know begins early and is updated until finally the opening bell, but indicator up here to get it delivered as soon as to your electronic mail box. The emailed model will be sent out at about 7:30 a.m. Jap.

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.