Oil surged on Tuesday morning on positive production news and weak dollar.

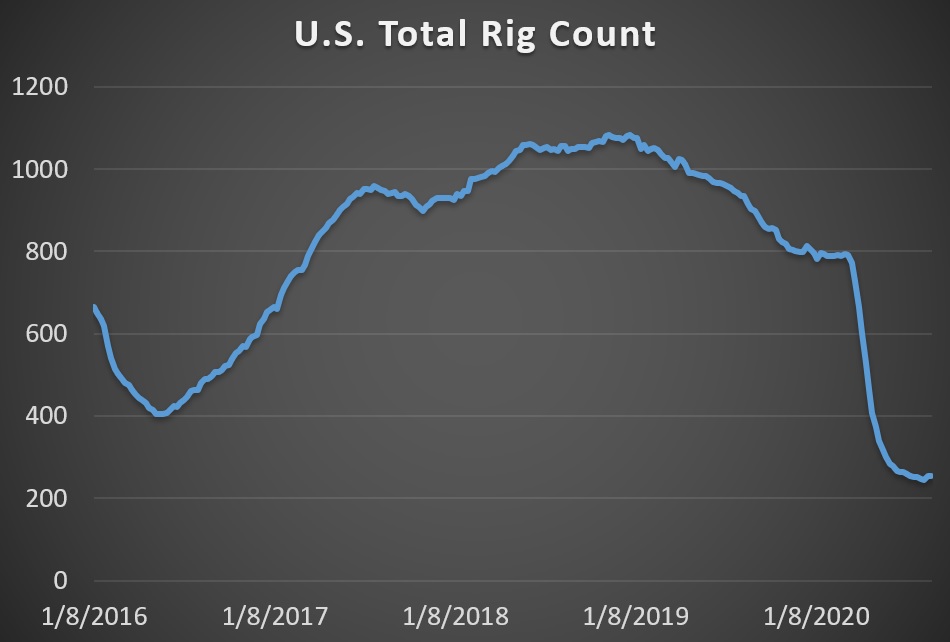

Weekly chart

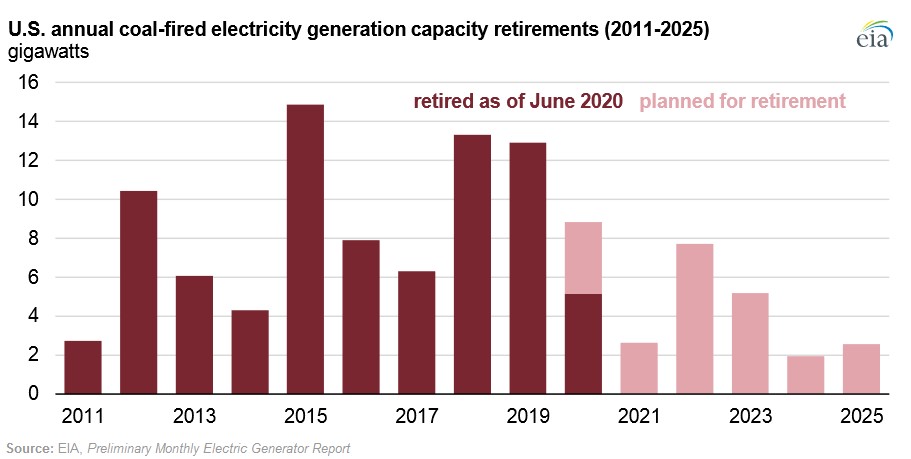

– From 2011 to mid-2020, about 95 GW of coal-operated capacity has gone offline, with another 25 GW ready to be shut down by 2025.

– The US coal fleet will arrive soon Leave At its peak in 2011, below 314 GW, below 200 GW.

– The rest of the plants have been used due to the declining competitiveness of coal.

Market movers

– Total (NYSE: TOT) Port Arthur is a refinery to wait Establishment of lightning restoration to resume operations following Hurricane Laura. Sitgo and Philips 66 (NYSE: PXD) Said it could take several days to assess the damage to their facilities at Charles Lake.

– Chesapeake Energy (NYSE: CHK) There is hope Cancel With a 300 million contract Energy Transfer (NYSE: ET), But the court ruled in favor of the energy transfer.

– Enbridge (NYSE: ENB) Said a fashore natural gas pipeline serving four sh fashore platforms in the Gulf of Mexico Stayed out of commission Due to the hurricane.

Tuesday, September 1, 2020

The new product boosted oil prices on Tuesday Data U.S. And from both sides of China, who did this amazing thing. The dollar also weakened, adding little support to crude. Still, crude is showing some signs of being able to break out of its current range.

Last boom distressed shell assets. Many US M&A deals are now “unfit” following the fall in the oil market. Reuters. In the largest 0 largest plant purchases between 2001 and 2019, only 31 of them will add value if Brent trades above $ 50 per barrel. for example, Diamondback Energy (Nasdaq: Feng) When he bought Energy in 2018, he paid about 97 9,977 per acre, a deal that would now be Brent if Brent averaged $$ 6 per barrel.

Mexico’s Gulf output remains below. As of Monday, the Gulf of Mexico had about 53 percent oil production Still shut-in, Following the destruction of Hurricane Laura. About 41 percent of natural gas production is shut-in. Employees are evacuated from 117 production platforms or 18 percent of the total. Related: Supermarkets are still struggling despite recovery in oil prices

EVS is still expensive to manufacture. EVs will be more expensive to produce for the rest of the decade than conventional gasoline and diesel-fueled vehicles, according to New research. EV production costs could average 16,000 euros by 2030 or 9 percent more than conventional cars.

Gold: No: Oil prices will jump to 65. Goldman Sachs expects Brent crude to reach ડ 65 a barrel in the third quarter of 2021, although it could end at a year-low, 58 58 a barrel, according to Goldman Sachs analysts. Analysts say it is likely that the Tutu vaccine will be widely available starting next spring, helping to support global growth and oil demand, especially jet.

The U.S. seized websites linked to the illicit oil trade. The United States announced today that it had seized three websites used by crusaders for the crude oil trade, according to an official press release. U.S. for oil trade with Venezuela by Iran. U.S.-backed U.S. According to the government – let the two recognized countries that are not allowed to trade oil live with each other.

Natural gas prices plummet on cold weather. U.S. Natural gas prices fell on Monday on expectations of lower demand due to the cold weather and low liquefied natural gas (LNG) feed following Hurricane Laura passing through the Gulf Coast.

Biden: “I’m not banning the king” In a speech Monday in Pittsburgh, Byden has denied allegations that it will target oil and gas drillers. “I don’t ban fracking. Let me say that again. I don’t ban fracking. It doesn’t matter how often Donald Trump lies about me, “said Biden Said.

UAE overproducts in August. UAE Break OP Gust pumps its OPEC + quota, 2.693 million b / d, according to the S&P Global Plate.

Damage from US SPR hurricane. US Department of Energy Said On Monday, the West Hackberry site of the Strategic Petroleum Reserve suffered “significant damage” from Hurricane Laura.

Profits of shipping companies amid recession. Cost cutting and To remove excess Capacity has kept shipping margins in positive territory this year.

The Trump administration is proposing to allow easy oil and gas into national forests. August 31 The Trump administration Issued A proposal that would make it easier to allow oil and gas drilling operations in national forests would streamline the permitting process between the Forest Service and the Bureau of Field Management. Environmental groups say the move would exceed environmental reviews.

US gasoline demand fizzling. Demand for American gasoline has soared since bottling in April, but has flattened in the last two months below the level of the last epidemic. Stable demand raises concerns about the health of economic recovery. “It’s easy,” said Noah Barrett, a US analyst at Janus Henderson Investors. WSJ. “It’s going to be really hard to get back the demand we lost in the last 10% to 15%.”

Trump admin prepares more sanctions on Venezuela. “We think our sanctions have been very effective in reducing the regime’s revenue but we think we can make them more effective. So we will do something to tighten in the near future, “said Elliott Abrams, the US special envoy for Venezuela. Reuters Interview. He did not elaborate but indicated that the new sanctions would include the removal of exemptions granted to third parties buying Venezuelan oil. Related: Bullish EIA inventory report pushes up oil prices

Tesla will sell 5 5 billion in shares. Tesla (Nasdaq: TSLA) Said he would Sell As much as 5 billion in shares “from time to time” to fund growth. Following the recent completion of the plant in Shanghai, the company plans to build new factories in Austin, Germany and Texas.

Exxon considers the job cut. According to a memo sent and received by employees on Monday Business interior, ExonMobil (NYSE: XOM) Job is thinking of a cut. According to the memo, including the job cut, the company is looking at its upstream unit for “organizational efficiency and lower activity levels.”

The total and mcquer query chases 2 GW offshore winds in South Korea. Total (NYSE: TOT) Will Spouse Recent push by French oil and gas giant to diversify into clean energy space, with the Green Bank of McCurry Group to develop more than 2 gigawatts of wind farms floating from South Korea.

By Josh Owens for OilPrice.com

Read more at oilprice.com:

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.