Editor’s notice: Some of our covid-19 coverage is no cost for viewers of The Economist Currently, our every day newsletter. For much more stories and our pandemic tracker, see our hub

THE IPO is dead, prolonged live the IPO. When the pandemic strike in March, first general public choices, specially these by technological innovation startups, have been predicted to be amid the early victims. Following all, who wants to go public in a after-in-a-century crisis?

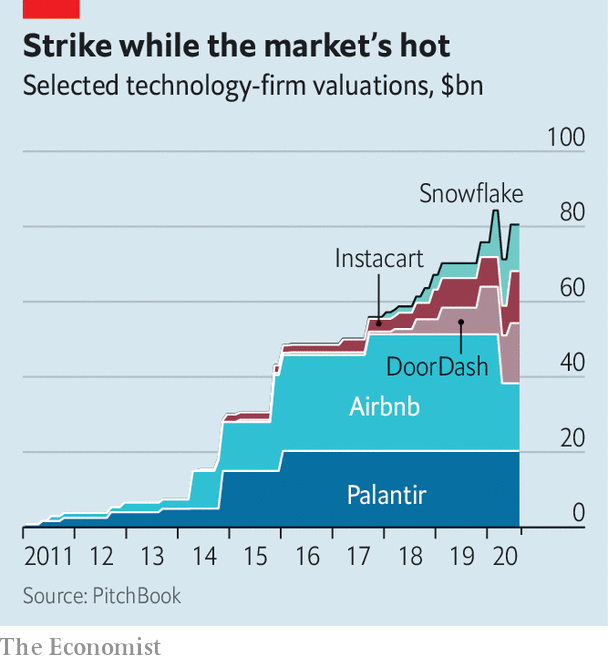

Quite a few folks, it turns out. In the past pair of months IPOs, which all but dried up until finally late May perhaps, have appear again with a vengeance in The us. None of Silicon Valley’s modern and forthcoming listings rivals that of Ant Team. The payments affiliate of Alibaba, an online large, wants to increase a report $30bn in China by October, which could worth the firm at close to $200bn. But America’s technological know-how startups have brought in $10bn so significantly this 12 months (see chart 1)—and there is extra to come. On August 19th Airbnb, which rents homes to travellers, submitted for an IPO. Other privately held “unicorns” reportedly completely ready for general public pastures include things like Snowflake Computing, which tends to make cloud software program DoorDash, which provides meals and Instacart, which provides groceries. Add Palantir, a cryptic info-administration company planning for a direct sale of current shares in public marketplaces, and the latest merged valuation of these 5 is $80bn, in accordance to Pitchbook, a knowledge company. Even if they float only a portion of their shares, billions-value of contemporary tech stocks will soon trade publicly.

This flurry of action has not attained dotcom-bubble territory from the change of the century, when dozens of startups floated every month. But there is a whiff of “irrational exuberance” in the air, detects Lise Buyer, who has watched technological know-how shares due to the fact the heady late 1990s and now will help startups with IPOs at Class V Team, an advisory agency. When Duck Creek, an coverage-tech organization, went community on August 14th, it closed approximately 50% higher. BigCommerce, an online-procuring system which floated a week before, observed its shares “pop” by more than 200%.

With the S&P 500 index of huge American companies at an all-time high, hardly ever head that covid-19 rages on, investors’ rationality is certainly up for discussion (see Buttonwood). But for numerous startups, the want to go community is perfectly rational, for two explanations.

The first has to do with the economical markets on their own. Enterprise capitalists who experienced been pouring billions into unlisted companies commenced to neat on frothy startups ahead of the pandemic, immediately after a number of unicorn listings disappointed (Lyft and Uber) or collapsed (WeWork). At the identical time, rock-bottom desire costs are pushing general public capital to find returns. As a final result, stockmarket investors are ready to settle for higher valuations, suggests Lauren Cummings of Morgan Stanley, an financial commitment bank and a primary underwriter of IPOs. “There is insatiable demand by general public buyers,” agrees Brian Feinstein of Bessemer Enterprise Associates, a undertaking-money (VC) firm.

Startups are keen to slake it before it dissipates. Many firms are thus dusting off listing programs that had been place on keep in the wake of the ride-hailing duds and the WeWork snafu. Their situation is bolstered because—and this is the second reason for startups’ listing-lust—the pandemic has been a boon for a lot of tech firms.

The 5 significant platforms—Alphabet’s Google, Amazon, Apple, Fb and Microsoft—have thrived as self-isolating shoppers commit much more time and revenue on the web, and corporations splash out on cloud-computing expert services to allow distant performing. On August 19th Apple briefly touched a sector capitalisation of $2trn, the initial American enterprise to do so. Not-so-major tech, too, has benefited, including quite a few providers that have not long ago gone public.

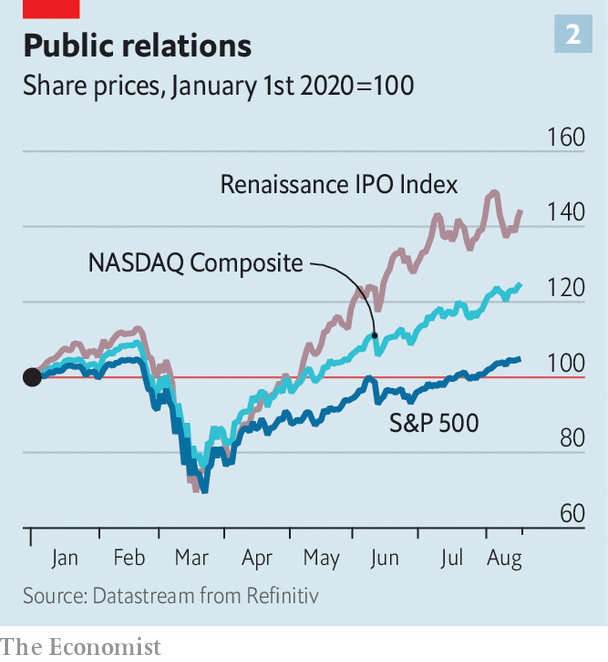

The pandemic has highlighted and sped up a essential shift in the direction of electronic corporations, suggests Sarah Cannon of Index Ventures, a VC business. The pattern will past for many years, she predicts. Marketplaces concur. The tech-large Renaissance IPO Index, which contains most listers of the past two yrs, is up by a lot more than 40% given that January (see chart 2). Zoom, whose videoconferencing app has grow to be ubiquitous amid lockdowns, has noticed its share selling price increase fourfold since floating in April 2019 it is really worth $78bn. CrowdStrike, a cyber-stability company which listed in June last calendar year, has quadrupled in price due to the fact March.

A single factor the most current growth has completed is emphasize how unsatisfied startups and VC corporations have developed with the present-day procedure of going general public. It is cumbersome, with reams of paperwork, and can choose much more than a calendar year. It is also pricey—and observed as too cosy for Wall Road. Expense banks’ service fees by yourself take in up concerning 4% and 7% of a normal IPO’s proceeds, not counting lawyers and other advisers. Startups and VC companies position to big very first-working day pops as evidence that offerings are underpriced to give banks’ major traders a speedy return. After all, those customers are regulars that will have to be held sweet, whereas most startups only go public when.

Disaffection with the IPO method, blended with a renewed drive to go general public, has led some companies to think about choices. A person is a “direct listing” of the kind Palantir is pursuing, and which Spotify, a new music-streaming service, and Slack, a company-messaging firm, have utilised to fantastic influence. Asana, which sells world-wide-web-based project-management application, may be a further unicorn to consider the direct route. Immediate listings use an electronic auction by the inventory exchange to get startups a fairer price for their shares than investment decision bankers may possibly. But they do not allow for companies to increase new income. As a outcome, they are an solution only for cash-loaded firms.

Another route that has received prominence is the particular-purpose acquisition company. These SPACs, as they are acknowledged for small, are shell companies that go public promising to obtain a person or more personal firms with the proceeds from the listing. The private organization then fills up the detailed shell by means of a reverse merger. SPACs have a dodgy background several have underperformed the broader stockmarket. But the latest good deal promise to resolve the flaws whilst preserving the rewards, which incorporate immediate negotiations about the invest in value that can make specials faster and more predictable. From January to early August 60 SPACs went community, elevating $22.5bn. In July Monthly bill Ackman, a hedge-fund boss, released a $5bn-7bn auto, the most significant so significantly.

It is unclear if Silicon Valley will embrace SPACs wholeheartedly. The biggest tech business to have employed a person is Nikola, a secretive zero-emission-lorry startup which now boasts a market place capitalisation of about $16bn. Quite a few business people and their backers would resist allowing their corporations be sucked up into a shell. But SPACs have a area in tech globe. On August 18th Kevin Hartz, an early investor in Airbnb and Uber, introduced just one. Ribbit Cash, a VC company, is reportedly setting up a different.

The IPO-industrial complicated is not averse to immediate listings or SPACs, even if they are less beneficial than the previous-school means. Bankers predict a assorted future of progressively tailor-produced flotations that, say, goal specific investors and predetermine how extensive workers ought to keep on to their shares. As Greg Chamberlain of JPMorgan Chase, a bank, sums up, “Not all technological know-how providers are the very same. They have various targets.” So extended as startups want to money in, as all eventually do, they will need Wall Street to shepherd them as a result of.■

This posting appeared in the Business segment of the print version less than the headline “Partying like it’s 1999”

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.