After this week, investors are expecting an improvement from electric vehicle maker Tesla (TSLA) On its Q3 production and delivery. The stock has been one of the biggest winners this year, and is currently expected to set multiple records this quarter thanks to two major vehicle manufacturing ramps. Today, I can focus on some key numbers to look at and discuss where the stock goes in this report.

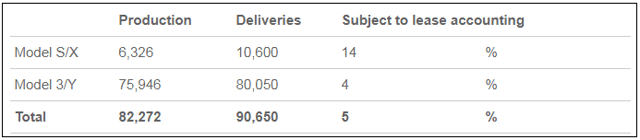

Before we start thinking about Q, let me remind you of what Tesla has noticed so far this year. In the graphics below, you can see the initial numbers provided by the company for production and delivery in Q1 and Q2. As a reminder, the Fremont factory was shut down for about two months due to coronavirus, mostly during Q2, and the Shanghai plant also experienced some downtime. Final numbers will be reported in the Q3 earnings report.

(Source: Tesla Q1 release, Saw here)

(Source: Tesla Q2 release, Saw here)

As a reminder, the company’s original forecast was for deliveries this year that could easily exceed 500,000 units, with production even higher. Despite the epidemic, management has dropped the delivery forecast on Q2’s report. Last week Battery Day eventCEO Elon Musk has called for 30% to 40% delivery growth this year, indicating approximately 477,952 to 514,718 units.

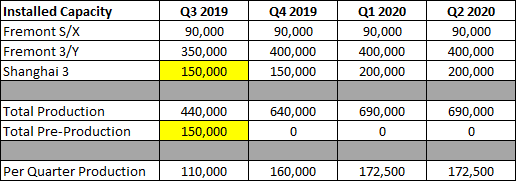

With the numbers above from the first half of the year, Tesla will clearly need six months to achieve its goals. As I suggested My most recent article, The company certainly has the established capacity to meet this growth forecast. The following graphic shows the products for this key metric and the last four quarters in the factory line.

(Source: Tesla Quarterly Investor Letters, Saw here)

If you average the end of the period for the last four quarterly quarterly production rates, you get 153,750 units. Obviously, given Shanghai and the Model Dell Y ramps, the company could do a little more at this stage, expecting a further 100,000 units of capacity growth by the end of next year. That 100K expansion was expected to occur in mid-2020, but the delay is quite justified given the coronavirus closure.

I would be happy to see if we add 50 or 100 tuck to the Model 3 / Y numbers in the Q3 report. If you do not consider an increase in installed capacity in the Q32020, production per quarter will increase by 169,375 units in the previous quarter on average. To predict my product, I’ll take that number with the 153,750 mentioned above, and divide by two. Then I’ll take a quarter of a week for maintenance and other things, and it gives me a Q3 production forecast of 149,135 units.

Late last week, i Publish a blog post Battery Day wrapped up where I discussed that the Q3 had a street average of 144,000 deliveries. In that part, I said that my personal forecast for delivery is units 0 units higher than that and that production will surpass the reach of 000,000. In the end, my production numbers went up by a few hundred units, but that’s not really a big difference.

I’m also excited to see where Tesla’s leasing percentage ends up for Q3. Model Y leasing came out much earlier than previous models, so we can see a shop in 3 / Y leasing percentage. While leasing at Tesla is better for the short term, it means much less revenue per delivered vehicle and even a slight impact on cash flow if too much is leased.

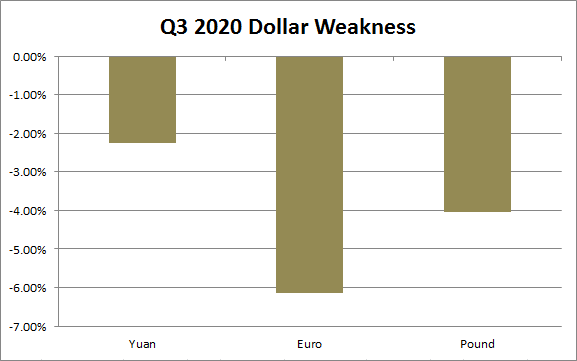

Using my Q3 number plus the actual of Q1 / Q2 Latest income report The company will be put in just over 324,000 units for a period of nine months. It will put Tesla on track to meet the forecast of the new annual guide and give the company a chance at 500,000 units. Of course, that means there will be another big gradual quarterly jump in deliveries, so investors will need to watch for a change in the price of the Tesla lineup next week. The chart below can give us some clues, showing how much the USD’s average daily close price in Q3 so far is below Q2’s average.

(Yahoo! Finance – Q3 numbers by 9/25)

With Volkswagen (OTCPK: VLKAF) With the introduction of its ID.3 a big rush in Europe, with the rise of Polystar 2, I wouldn’t be surprised if at least the price of the Model 3 in the Q4 in the Tesla continent drops. The company could easily say it is passing on weak dollar lor savings, but there will also be a way to boost this demand as Tesla Q4 looks to accelerate delivery. We’ve already seen the loan program in the wayway at the end of Q3, and Tesla’s Netherlands site will now publish the next step in the country’s EV benefits program later this year.

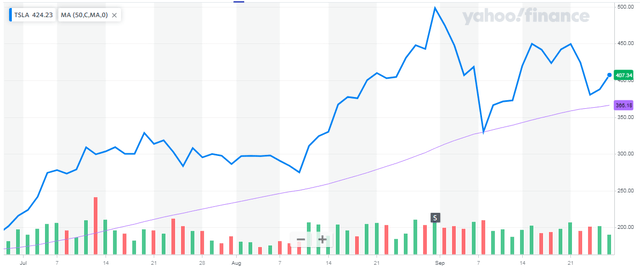

Speaking of Tesla shares, they are also a huge winner with their all-time high stretch. As the chart below shows, the stock is above its 50-day moving average, which seems to support the name in recent months. This key trend line is still rising, but if some bad news comes out this week, it will be interesting to see what happens if the stock falls below it for more than a day or two.

(Source: Yahoo Finance)

Finally, Tesla’s Q3 production and delivery report should be the next major catalyst for the stock this week, following the release of the Battery Day event dude last week. All indications are that the record quarter will be detailed, but how close will Tesla come to its established production capacity? With Elon Musk calling for at least 30% delivery growth this year, the strong Q3 is just the beginning, as the company will need even more Q4 to hit its annual forecast.

Advertisement: I / We have no place in any of the stocks mentioned, and have no plans to start any position in the next 72 hours. I have written this article myself, and it expresses my own opinions. I don’t get paid for it (except for finding Alpha). I have no business relationship with the stock mentioned in this article.

Additional advertising: Investors are always reminded that before making any investment, you should make a proper effort yourself on any name directly or indirectly mentioned in this article. Investors should also consider consulting a broker or financial advisor before making any investment decisions. Any content in this article should be considered general information, and should not be relied upon as a formal investment recommendation.

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.