(Bloomberg) – European stocks fell the most since July after reports of bank allegations and signs that London was heading for a second lockdown. US equity futures sank and the Treasury rose.

Airlines and travel companies were hurt in the Europe Stocks 600 index. HSBC Holdings plc fell to its lowest level since 1995 and shares of European Bank fell following reports by international consortium Investig f Investigative Journalists about defects in suspicious activity reports.

As cases of the virus spread across Europe, there is growing speculation that authorities may be in danger of imposing stricter sanctions and stifling economic growth. Chief Medical Officer Chris Witty is due to warn on Monday that the UK is on a “crucial issue” and Germany’s health minister has said the trend in Europe is worrisome.

Traders also said the U.S. political battle over who would be the Supreme Court justice is also weighing on the spirit. Senate Majority Leader Mitch McConnell has said he will ensure a vote to confirm Donald Trump’s candidacy to become a judge on Friday following the death of Justice Ruth Bader Ginsberg. But Democrats are battling efforts to push the vote forward, with presidential candidate Joe Biden warning that it would “irreversibly harm” the country.

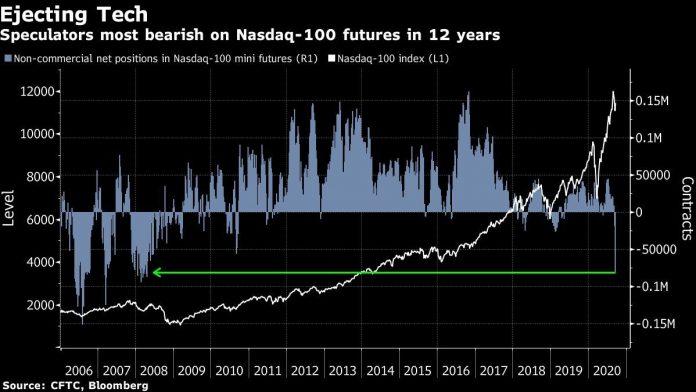

The most popular on the Nasdaq-100 since 2008 is:

Peter Rosenstreich, head of market strategy at Swissquote Bank SA, said the market is concerned about the pervasive risks coming from the US: Kovid, the Supreme Court fight and the upcoming presidential election. “Looking weaker in U.S. tech stocks, the need to jump straight into U.S. assets seems less complicated.”

Equity trading was dominated in Asia. Japan’s stock market was closed for the holiday. The Hang Seng Index fell 1.5%, while equities in China and Australia also retreated. Taiwan’s dollar has strengthened to the level seen in seven years.

Elsewhere, the European Central Bank has begun reviewing its epidemic bond-buying program to see if it should continue longer and extend its extraordinary relief to older programs.

Despite global equity valuations approaching nearly two-decade highs, fund flow data shows that money is flowing into US stocks. With the Fed anchoring interest rate close to zero for the foreseeable future, it is expected to make a small profit from the epidemic.

“There are a lot of expectations about the economic resilience of the United States,” said Fabrizio Fioriini, chief investment officer of the American SGR SPA. “It simply came to our notice then. The risk of an election is underestimated. “

The main moves in the markets are:

Stocks

The S&P 500 index was down 1% at 9:16 a.m. London time. Stocks Europe 600 Index fell 1.6% .MSCI Asia Pacific Index fell 0.4% .MSCI Emerging Markets Index fell 0.7%.

Currency

The Bloomberg Dow Spot Index fell 0.1%. The euro rose 0.1% to 18 1.1824. The British pound rose 0.2% to 104.11 per dollar.

Bonds

Production on the 10-year Treasury has plunged two basis points to 0.66%. Yields on the two-year Treasury have fallen by less than one basis point to 0.14%. Germany’s 10-year yield has fallen by one basis point to -0.51%. Britain’s 10-year yield has dropped by one basis point to 0.156% .Japan’s 10-year yield has dropped by less than one basis point to 0.015%.

Goods

West Texas Intermediate crude fell 1.3% to ડ 40 a barrel. Brent crude fell 1.3% to. 42.13 a barrel. Gold rose 0.1% to 9 1,946.48 an ounce.

For more articles like this, please visit Bloomberg.com

Register now To stay ahead with the most reliable business news source.

20 2020 Bloomberg L.P.

Coffee enthusiast. Travel scholar. Infuriatingly humble zombie fanatic. Thinker. Professional twitter evangelist.